Is investment banking ready for natural language generation?

Natural Language Generation (NLG) is a subfield of artificial intelligence that uses data to produce language.

This may not sound that relevant to investment bankers, but it should be.

NLG and its various forms have been around for some time. What’s changed is its application in enterprises over the past five years, especially finance.

Do you remember the most recent ratings or equity research document you read? Chances are it wasn’t written by a human but by NLG technology (in fact, I would go as far as to say that the proliferation of NLG produced documents in finance is actually creating a problem as firms can increase their output from a few reports a day to thousands).

Narrative Science, a leader in the NLG field notes:

"People have always communicated ideas from data. But with the explosion of data that needs to be analyzed and interpreted, coupled with increasing pressures to reduce costs and meet customer demands, the enterprise must find innovative ways to keep up."

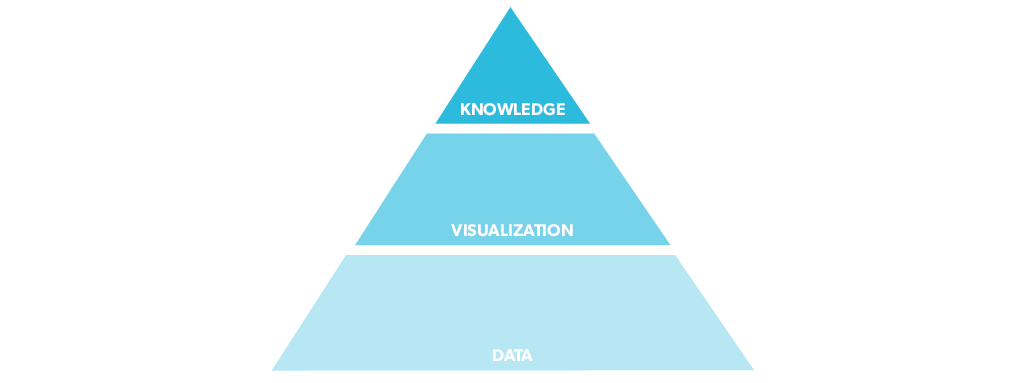

Investment banks have traditionally relied on a combination of both visualizations and words to communicate data-driven insights. In fact, it’s pretty uncommon to see a text- or visual-only investment banking document.

At Pellucid, we've focused on the visual side of the equation, reducing the costs of turning data into visualizations, but that doesn’t mean the text side of the equation, and the potential for creating the same streamlined improvements, should be ignored.

Most of our clients see Pellucid as a pyramid; we turn data into visual insights and then the bank adds their knowledge with short prose that hammers home the key messages. This collective effort gets the deck over the finish line.

Take the example of the page below. The data visualizations bring out the insights, and the keynote brings the message home.

It would seem that due to the nature of the content created by bankers, NLG can only go so far. Pitchbooks do not homogeneously share a rigid structure like equity and ratings reports, and the data in a pitchbook does not follow a standard sequence. However, this isn't quite true.

Back in the early days of Pellucid, we spent a lot of time dissecting pitchbooks to see what was really in them. We found out that on average, bankers think they use around 150 different sets of pitchbook analysis throughout their career. This may not sound huge, but it's not the same 150 sets for each banker, in fact, the analysis used is quite wide-ranging.

The uniqueness of each pitchbook means that any value that can be delivered using NLG is marginal, but what if the content is viewed as microcontent? Thinking about pitchbooks as a series of smaller pieces stitched together can provide pretty big benefits when considering content reuse and generation. And, admittedly while it would come at the cost of the bigger picture and personalization, using NLG to create a solid first draft which is then edited may be better and faster than beginning each project with a blank slate.

Over time, I am optimistic that NLG will have a great impact on pitchbooks, however, right now I consider the low hanging fruit to be committee memos.

Unlike pitchbooks, credit and valuation committee memos follow a standard template with similar exhibits and structures, giving them a lot in common with ratings and equity research reports. So it makes sense that by using either templatized or advanced NLG methodologies, the creation of these items should be possible to automate. In fact, I think it’s probably possible to automate at least 95% of the creation process. And, given the distaste most bankers have for pulling together these documents, and the cost savings the automation would present, this seems like a win-win.

Are there other areas of investment banking where NLG would make a lot of sense? Email me at adrian.s.crockett@gmail.com with your thoughts.