Investment bankers should think like content marketers

If you ask any investment banker about what they do each day, producing content will be at the top of the list (although they probably would have phrased it as "creating pitchbooks").

Through the combination of creating pitchbooks, emails, weekly updates, internal memos, CIMs, and case studies, investment bankers spend a significant portion (if not the majority) of their time producing both internal and external content.

Given that human capital costs are the largest dollar amount of an investment bank’s expense line, and content production requires a significant amount of manual labor, it seems prudent for investment banks to ask two questions when creating content:

- Are we creating the right content?

- Is it as efficiently created as possible?

The second question can be solved if you use the right tools and processes and by leveraging existing content to cut down on the manual, repetitive work. This is where Pellucid comes in; it can create a pitchbook in a fraction of the usual time giving you longer to devise analysis and come up with ideas. However, back to our first question, what does this extra time really matter if the content is wrong?

Bankers and content marketers

Investment bankers can learn a lot from content marketers. While the sales process of investment banking is unique, there are a variety of lessons that we should be incorporating into the industry.

So what is content marketing?

Twenty years ago when a salesperson called on you, they usually had the upper hand; they possessed all of the information and buyers were stuck in an information void. However, as with many other things, this changed with the internet. From knowing how a product works, to comparing pricing, to reading consumer reviews, everything is a Google search away.

This new dynamic shifted power away from the company to the consumer. As such, organizations have had to become more and more concerned about what is being said about them. In an effort to control and contribute positively to this, companies now provide potential clients with a plethora of information that will help them make their buying decisions. Welcome to the world of the content marketer.

Over the last 13 years, “content marketing” has established itself as a common marketing practice, just see how it’s trended upward in Google searches.

Why is this notable?

- As content marketing has exploded, there is a wealth of data on what works and what doesn’t.

- Marketers are a chatty bunch. Unlike investment bankers who hold their cards close to their chests, content marketers are eager to share what they’ve learned from different marketing strategies and campaigns (just search for people who call themselves a “content marketing guru” on LinkedIn and you’ll see what I mean).

- If you talk to a content marketer, you may be surprised at how similar the discussions and pain points are between content marketers and investment bankers. Sure the language is different, but we all know that each profession only relies on jargon out of protectionism. So once you have a mapping between key phrases from both parties, you’ll see there are many overlaps.

What bankers can learn from content marketing

A key concept from content marketing is to view content as building blogs for larger pieces. Micro pieces of content are the foundations of a successful, leveragable, and cost-efficient content marketing strategy.

For example, take the creation of an infographic. A small building block that works best on social channels.

Infographic by itself: Pinterest, Snapchat, and Instagram

But, by adding additional pieces of content, you can build it out for different channels:

Infographic + Micro text = Tweet

Infographic + Small text = Email, LinkedIn, Facebook

Infographic + Large text = Blog

Infographic + Other building blogs + Large text = eBook, Whitepaper

Infographic + animation + voice = Video

So how does this apply to pitchbooks? If you use share price charts, comps trading tables or company profiles in most of your books, these are all examples of microcontent which is then highly tailored to the interpretation of the situation in which you are pitching, similar to how the infographic is supplemented with text for different distribution channels.

There’s also a relationship between the quality of the building block and the content that needs to be created, basically the higher the quality of pitchbook visualization, the less you have to write as you can rely on the chart to work a little harder (as they say, a picture is worth 1,000 words).

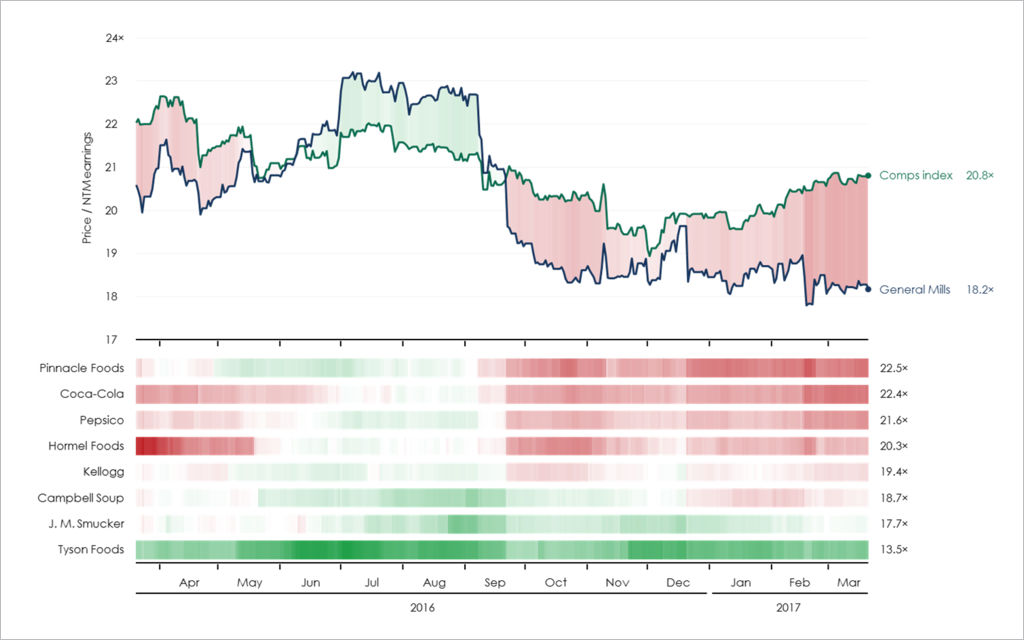

One of my favorite examples of this in action is a metric vs. comps over time chart

The chart does an excellent job of showing the comps set performance data, but when combined with other building blocks of content it delivers so much more. Usually, this would be in the form of a commentary box, maybe adding some thoughts about what this signals about the broader industry or expected trends.

However, adding a few more elements to the chart itself such as value intensity bars or “good/bad” shading shows the same data, but with much more context, leading to a visualization that requires less additional work, which is therefore much cheaper to produce.

Both content marketers and investment bankers use microcontent as the building blocks of their materials, however, content marketers have been much faster to adopt efficient creation strategies and to understand how to leverage content for different audiences.

Let me know your thoughts on what else investment bankers can borrow from other industries at adrian.s.crockett@gmail.com.