The cost of a personalized pitch

It may be pretty obvious that the more personalized a piece of content, the more effective it will be. What may be less obvious is that this personalization comes at a cost.

In a previous post, I wrote that investment bankers can learn a lot from content marketers, but when it comes to the personalization of content, there are limits.

Let's compare how investment bankers and marketers consider content personalization:

Content marketers:

A content marketer will create highly personalized emails, triggered by events or actions. You probably receive several of these a day, reminding you to finish checking out online, or letting you know about a specific deal, or sharing a targeted blog post. While these emails are specific, they are short (and probably automated) so the cost of creation is pretty low.

On the higher end of the scale, marketers will spend a significant amount of time on an ebook. However, the creation cost is amortized over time as it will be used to generate leads, added to the website as a resource, and shared as thought leadership, in addition to being broken into smaller pieces and disseminated across multiple channels. The long shelf-life of the content will pay dividends for years. An example of this is Moz’s SEO for beginners guide. Released in 2015, it dominates search results and is regarded as essential content for this topic (and it helps that Moz chose a topic that every marketer has to have at least a basic understanding of).

How does this compare to investment bankers?

Investment bankers:

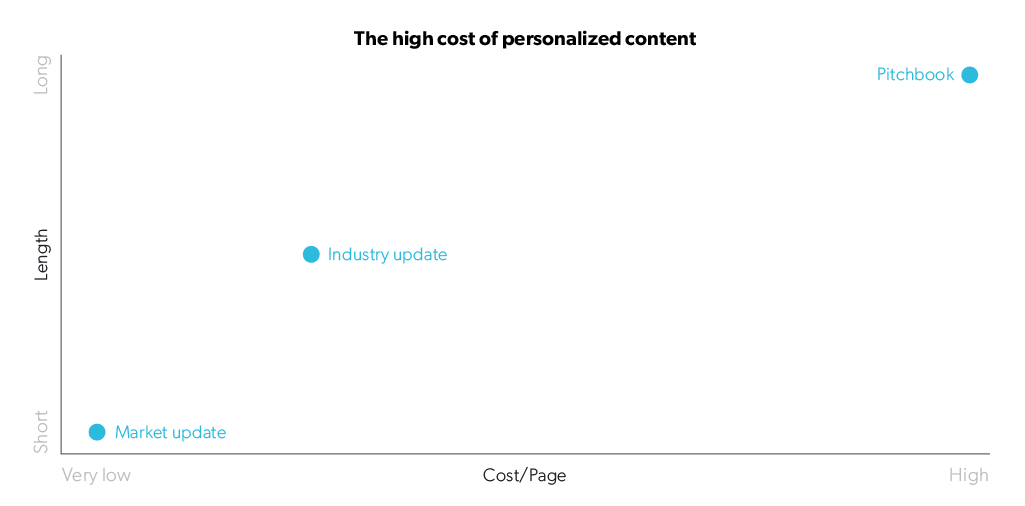

For bankers, the inverse is true; the smaller the audience, the longer the content piece. Pitchbooks frequently run to 100+ pages and take weeks to produce, yet are only ever seen by a handful of people.

Looking at these relationships in terms of total cost, with cost/page multiplied by the length of each item on a scatter chart, the difference is striking.

This cost can be reduced with greater investment in the foundations of micro-content. Take a share price chart, a straightforward piece of content. It will likely find its way into many of your pitchbooks so should be produced as efficiently as possible.

Based on a recent survey we conducted about pitchbook creation, a share price chart takes on average 15 minutes to create, including extracting the data from the terminals. Broken down into the hourly cost of human capital, that’s about $18.75 to produce a pretty simple piece of content. Assuming an analyst works on one pitchbook a week and needs to update that share price chart at least twice per project, this adds up to about $1,800 (and about 3.5 working days) just producing share price charts.

I think it’s perfectly reasonable—and within reach of most investment banks to slash the creation cost by 75%, saving nearly $1,500 per analyst. And remember, this is just on share price charts alone, one of the simplest pieces of content there is to create. All you need to do is efficiently produce these building blocks of content.

The marketing industry has already figured how to cut the cost of creation by automating content creation and generating items that can be stitched together. It’s time for investment banking to explore how to do the same, finding ways to offer high client value, but without the high cost.

Are there other industries investment banking can learn more? Email me at adrian.s.crockett@gmail.com with your thoughts.