It’s election time. Will there be a spike in special dividends?

The re-emergence of Sarah Palin and her run-on sentences means presidential election season is in full swing. But, does the 2016 election signify we should also expect an increase in investor payouts in the form of special dividends? This question arose during a recent client meeting and presents a good opportunity to dig into the cyclical nature of special dividends and what impacts their payout.

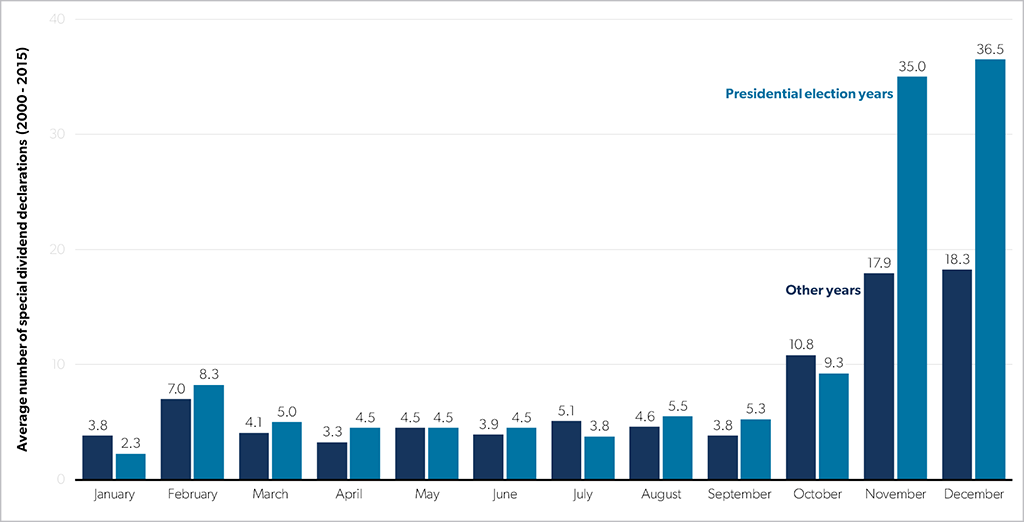

To look at this, we took the last 16 years worth of special dividend announcements made by any of the companies that form the U.S. total market index, about 3,000+ total with 1,542 announcements, and averaged them by month. As expected, due to annual tax planning, there was a massive bump in the total number of special dividend announcements in the later months of the year, with nearly 50% of them in the last two months alone.

But what we want to know is: does this change in the years leading up to a presidential election?

It certainly looks like it does. There is a significant increase that coincides with when everyone heads to the polls.

But, a deeper exploration shows there is more to this story.

Zooming out to look at special dividends on a monthly basis over time reveals that the prior result was driven by a massive spike in special dividend announcements at the end of 2012. Compared to previous elections, this was a one-off instance and not cyclical, recurring behavior.

What happened in 2012? Bush tax cuts were due to expire and it was widely (and quite rightly) believed that the reduced tax rates applicable to special dividend payments wouldn’t be extended under President Obama.

Introduced in 2001, the Bush tax cuts reduced the tax on qualified dividends, relative to salary and other ordinary income, down to about 15% compared to the usual 36% or so (actual rates vary by tax bracket). The impending expiration of this arrangement, quite sensibly, increased investor demand for companies to pay out special dividends before the resumption of the higher tax regime. For corporate America, the choice was: act now or wait, and possibly cause your shareholders to lose an additional 20+% to Uncle Sam; a pretty easy decision for many companies, especially those with large cash balances and powerful inside shareholders.

So 2012 was a blip. In fact, when we again compare the special dividend announcements of election to non-election years but strip out 2012 data, we actually see the reverse relationship. Usually, there’s a big down-tick in election years for special dividends.

Looking at the presidential hopefuls’ current election agendas, there appears to be nothing likely to drive 2016 to be a replay of 2012’s special dividend levels (although Trump’s continual dominance of the Republican race shows anything is possible).

So while the number of special dividend announcements and the timing thereof is clearly tax incentivized, there’s no evidence to suggest a “multiplier effect” in election years.

Do you have any market quirks or cycles you’d like to explore? Email me at adrian.s.crockett@gmail.com.